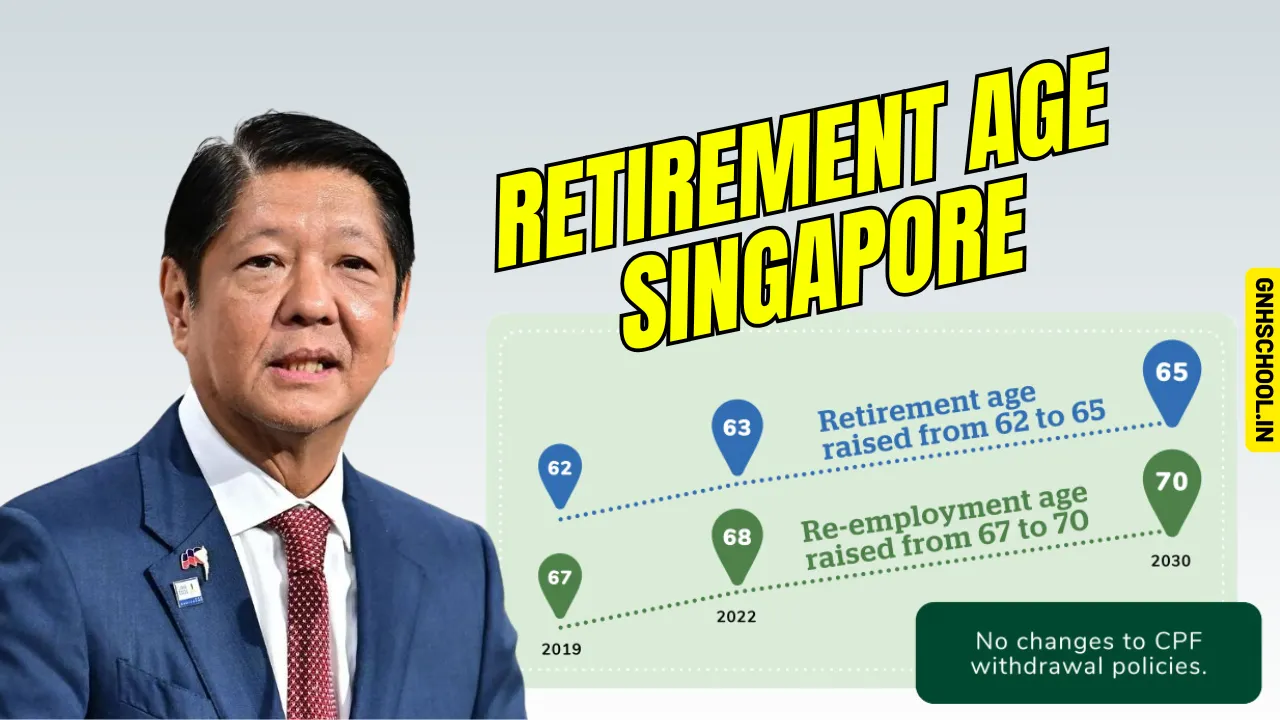

Retirement Age Singapore: The retirement landscape in Singapore has seen significant changes in recent years as the government adapts policies to meet the needs of an aging workforce. The latest updates bring adjustments to the retirement age and re-employment age, allowing workers to extend their careers while maintaining financial stability.

With an increasing number of senior employees choosing to remain in the workforce, authorities have raised the official retirement age from 63 to 64 and the re-employment age from 68 to 69. These changes are part of a broader plan to further increase the retirement age to 65 and the re-employment age to 70 by 2030.

While these adjustments provide greater financial security for older employees, they also introduce challenges such as workplace age diversity and employment competition. This article explores Singapore’s new retirement policies, their impact on workers, and the government’s support measures for senior employees.

Overview of Retirement Age Singapore With New Changes

| Category | Details |

| New Retirement Age | 64 (previously 63) |

| New Re-employment Age | 69 (previously 68) |

| Target Retirement Age by 2030 | 65 |

| Target Re-employment Age by 2030 | 70 |

| Eligibility for Retirement | Singapore citizens and permanent residents |

| Government Support | Senior employment credits, CPF benefits, pension schemes |

Understanding the Updated Retirement Age in Singapore

The decision to increase the retirement and re-employment age is a response to a growing trend among older workers who prefer to remain employed longer. Many seniors seek to extend their careers not only for financial reasons but also for personal fulfillment and social engagement.

The adjustments ensure that employees cannot be asked to retire before they reach the official retirement age. Additionally, the re-employment age allows eligible workers to continue working under renewed contracts if they meet performance and health requirements.

Key Changes in the Retirement Policy

- The official retirement age is now 64, meaning employers cannot require employees to retire before this age.

- The re-employment age has increased to 69, allowing senior workers to extend their employment through renewed contracts.

- The goal is to gradually increase the retirement age to 65 and the re-employment age to 70 by 2030.

These adjustments provide stability for senior workers, allowing them to contribute to the economy while securing their financial future.

Effects of the Retirement Age Adjustment on Employees and Employers

Benefits for Employees

- Extended Income Security

- With a longer working period, employees can continue earning salaries before fully retiring, reducing financial stress.

- Greater Retirement Savings

- Longer employment means higher CPF contributions, ensuring a more secure retirement.

- Continued Career Growth

- Many seniors enjoy their jobs and wish to stay professionally active beyond traditional retirement age.

- Better Social Inclusion

- Remaining in the workforce helps older employees maintain social connections and avoid isolation.

Challenges for Employees

- Workplace Adaptation

- Employees must keep up with new technologies and evolving job requirements to remain competitive.

- Health Considerations

- Working longer requires good physical and mental health, making well-being a priority.

- Delayed Retirement Plans

- Some individuals who planned to retire earlier may need to adjust their financial strategies based on the new age limits.

Impact on Employers

- Increased Workforce Diversity

- Employers will need to balance a workforce with multiple generations, ensuring collaboration between younger and older employees.

- Higher Payroll Costs

- Extending the retirement age means longer salary commitments, impacting payroll budgets.

- Workplace Adjustments

- Companies may need to adapt work environments and policies to support an older workforce.

While these challenges require careful planning, the benefits of retaining experienced employees outweigh the difficulties, as businesses can leverage their expertise and skills.

Who Is Affected by the Retirement Age Adjustments?

Employees Eligible for the New Retirement Policies

The updated retirement age applies to Singapore citizens and permanent residents who meet the following conditions:

- The individual has been employed with the same company for at least two years before reaching retirement age.

- The employee has maintained good health and work performance, making them eligible for re-employment.

- The employee’s job is not in a sector that follows different retirement rules.

Employees Not Covered by the New Retirement Rules

Some professions and employment categories are exempt from the updated retirement age. These include:

- Personnel in law enforcement agencies, such as police, civil defense, narcotics, and prison services.

- Singapore Armed Forces members, as they follow separate retirement policies.

- Employees working fewer than 20 hours per week.

- Short-term employees with less than two years of service.

- Commercial airline crew members, who follow industry-specific retirement rules.

These groups operate under different employment policies due to the nature of their work and organizational requirements.

Government Support for Senior Workers

To help older employees transition into extended employment, the Singapore government provides several support programs and financial incentives.

Employment Support Programs

- Senior Employment Credit

- This initiative provides financial incentives to employers who continue hiring older workers.

- Workplace Fairness Legislation

- Ensures that senior employees receive equal opportunities and are not discriminated against due to age.

Financial and Retirement Assistance

- CPF Retirement Benefits

- Longer employment means higher CPF contributions, improving financial security after retirement.

- Government Pension Schemes

- Some retirees, such as government employees, receive non-contributory pensions from their employers.

- Healthcare and Financial Aid

- Seniors may qualify for subsidized healthcare, cash benefits, and grants to ease financial burdens.

Steps for Employees to Prepare for a Longer Career

- Review Retirement Plans

- Employees should assess their retirement savings and CPF contributions to plan their financial future.

- Maintain Professional Skills

- Upskilling and learning new technologies can help senior workers remain competitive in the workforce.

- Monitor Health and Well-Being

- Staying physically active and mentally engaged ensures productivity in later years.

- Discuss Re-employment Options

- Employees should have open discussions with their employers about potential contract extensions.

Frequently Asked Questions (FAQs)

What is the new retirement age in Singapore?

The retirement age has increased to 64, while the re-employment age is now 69. The government plans to further raise these to 65 and 70 by 2030.

Can an employer ask an employee to retire before the official retirement age?

No, under the Retirement and Re-employment Act, employers cannot dismiss employees based on age before they reach the official retirement age.

Who is not affected by the new retirement age policies?

Certain professions, including police officers, military personnel, and airline crew, follow separate retirement policies and are not covered under the new age limits.

How does the increase in retirement age benefit employees?

Workers can extend their careers, earn income for a longer period, and increase CPF contributions, leading to greater financial security.

What government support is available for older employees?

The government offers senior employment credits, CPF benefits, pension schemes, and workplace fairness legislation to help older workers transition into longer employment.

Conclusion

The increase in the retirement age in Singapore reflects changing workforce needs and the desire of older employees to remain active in their careers. While these adjustments provide financial security and job continuity, they also require adaptations in workplace policies and employment planning.

By taking advantage of government support programs, upskilling opportunities, and financial planning, senior employees can successfully navigate these changes and continue contributing to the workforce in a meaningful way.